Grow

your fintech

Launching payment products can be complex:

but not with Crunch.

Our products

Our tried and tested tools and processes scale your innovation, so you can focus on growing your business.

We’ve issued 1.6M cards

We are licensed to operate in 50+ countries

Customers have loaded £128M onto our cards

What does Crunch do?

Crunch Payments offers an end-to-end card payment platform that solves your problems

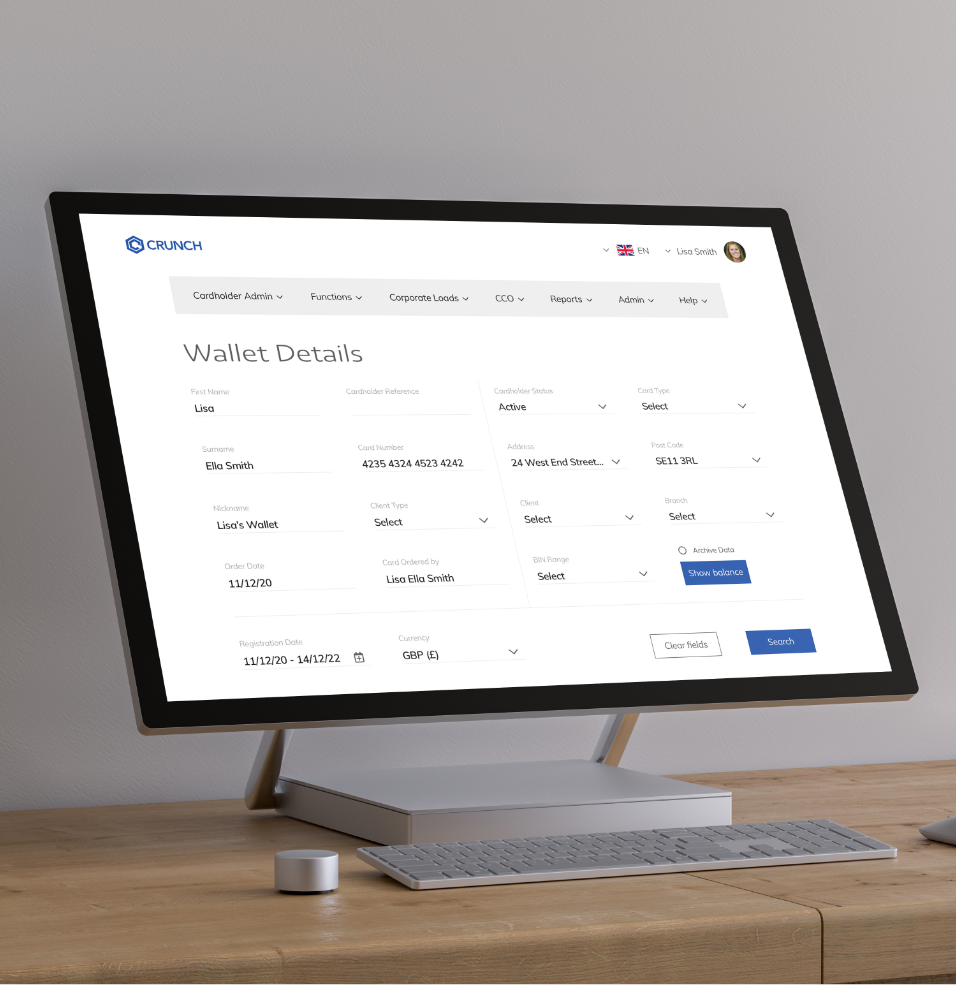

Card management

platform

Our card management system allows you to handle everything from new card requests, to cardholder permissions and email communications.

Card

issuing

Crunch will help issue your own branded cards. We’ll manage the requirements, liaise with the issuing bank, Mastercard® and the card manufacturer.

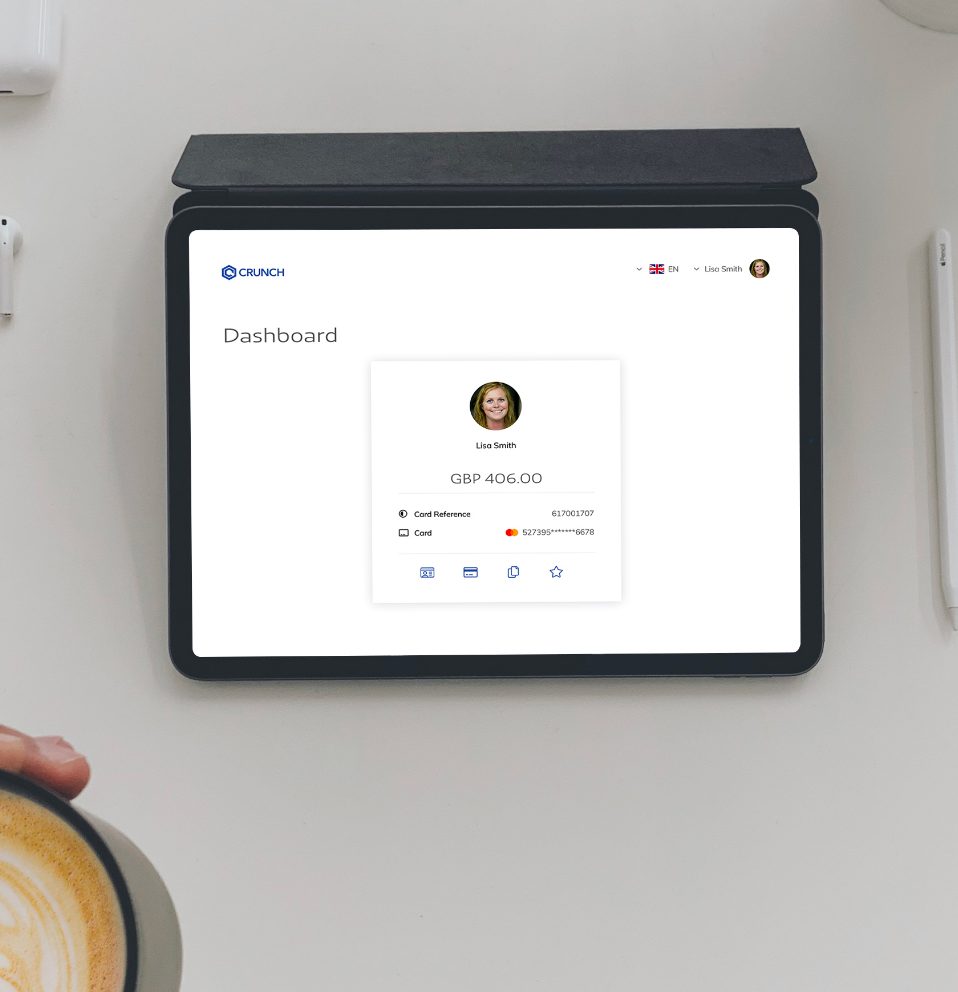

Cardholder

portal

Our ready-made portal empowers your cardholders to manage their cards online, allowing them to make transactions, view balances, manage email alerts and more.

Smartphone

app

Cardholders can also manage their money and cards in real-time through our customisable smartphone app. The feature-rich Crunch App can do everything from balance transfers to instantly blocking lost or stolen cards.

What makes Crunch special?

Every one of our tools is customisable so you can create your own bespoke solution.

White label

our products

All of the products in our ecosystem can be white labelled and customised to your needs. We’ve done the work so you don’t have to.

Save time

& costs

We have the contacts and connections you need to massively speed up your go-live, cut the costs of getting your innovation to market, or implement a new system in your business.

Get a full

turnkey solution

Crunch makes it as easy as possible for you to reach that launch date. From planning through to the complexities of implementation, we bring your payment product to life.

Weight off

your shoulders

Crunch takes all of the responsibility for a seamless payment product launch and ensures all parties are covered in terms of liability, legalities and compliance.

Get started with Crunch

Our team of FinTech industry experts are here to help

Frequently asked questions

Our team know the payments industry inside out. You’re in the best place if you’re looking to take your innovation to the next level.

-

Who are we?

We are Crunch Payments Ltd a prepaid card management program. Over the last 7 years, Crunch has helped numerous innovative Fintechs and startups to launch their bespoke card programs by offering them access to our extensive ecosystem, as well as our established relationships with trusted Fintech providers.

-

How does Crunch work?

Crunch provides the multiple key components required to launch a prepaid/debit or virtual card under one umbrella. Crunch offers clients a single system and agreement, which gives clients access to our established relationships with trusted card issuers (banks), card manufacturers and card processors.

Crunch lets you concentrate on product, marketing and customer relationship, whilst relying on our expertise and experience to navigate your Fintech product launch.

-

What is on offer?

Crunch offers a complete package for your card product launch, including: client portal, cardholder app, APIs, approved scheme connectivity, integration with our card issuer, card processor, card manufacturer, compliance and KYC providers.

However, you could choose a more ‘à la carte’ menu. Pick and choose from a range of options including:

- Our app or your app (using our extensive APIs)

- Our responsive web-based system or integrate your system using our API’s

- Our card stock or create your own card design

-

What is a program manager?

Launching a card scheme requires agreements with multiple partners. A program manager pulls all of these into one simple agreement. That means fewer negotiations, less paperwork, more cost efficiency, faster delivery and more time to focus on your business.

-

What do I need?

An Idea!

You don’t need an Issuer, a Processor, a Fraud System, a Card Manufacturer or an IVR. All you need is an idea and a plan and Crunch will help you build it.

View our full list of services here.

-

What size company do I need to be to use your product?

We work with small businesses to large companies. Our product is aimed to scale up from one card to any number. Let’s discuss!